IPU provides a range of online digital banking and payment solutions, including

international transfers, remittances, currency exchange, and business banking

services.

Our fees vary depending on the type of service. Please refer to our pricing page or contact our support team for detailed

information about fees.

IPU is a licensed Electronic Money Institution, regulated by the Bank of Lithuania

(License No. 39) and subject to the European Central Bank’s regulatory framework,

ensuring we meet the highest standards of security and compliance.

You can reach our customer support team via email at [email protected] or via chat support

in-App. Please visit our customer support page for more

ways to get in touch.

IPU supports a wide range of currencies for international transactions. Please check

our multi-currency account page or contact support for

the full list of supported currencies.

Security is our top priority. We use advanced encryption and security protocols to

protect your transactions and personal information.

To verify your identity, log in to your IPU account. If you are a new client, follow

the sign-up instructions. If you are an existing client looking to re-verify your

identity, go to the “My Account” section and follow the instructions to upload the

necessary documents, such as a government-issued ID. The verification or

re-verification process usually takes 1-2 working days to complete.

If you forget your password, click on the "Forgot Password" link on the login page

and follow the instructions to reset your password.

Yes, IPU offers a mobile app that allows you to manage your accounts, transfer

money, and access other services on the go. Download our app from the App Store or

Google Play.

Partnering with IPU gives you access to reliable financial solutions, competitive

rates, advanced technology, and a global network to support your business growth.

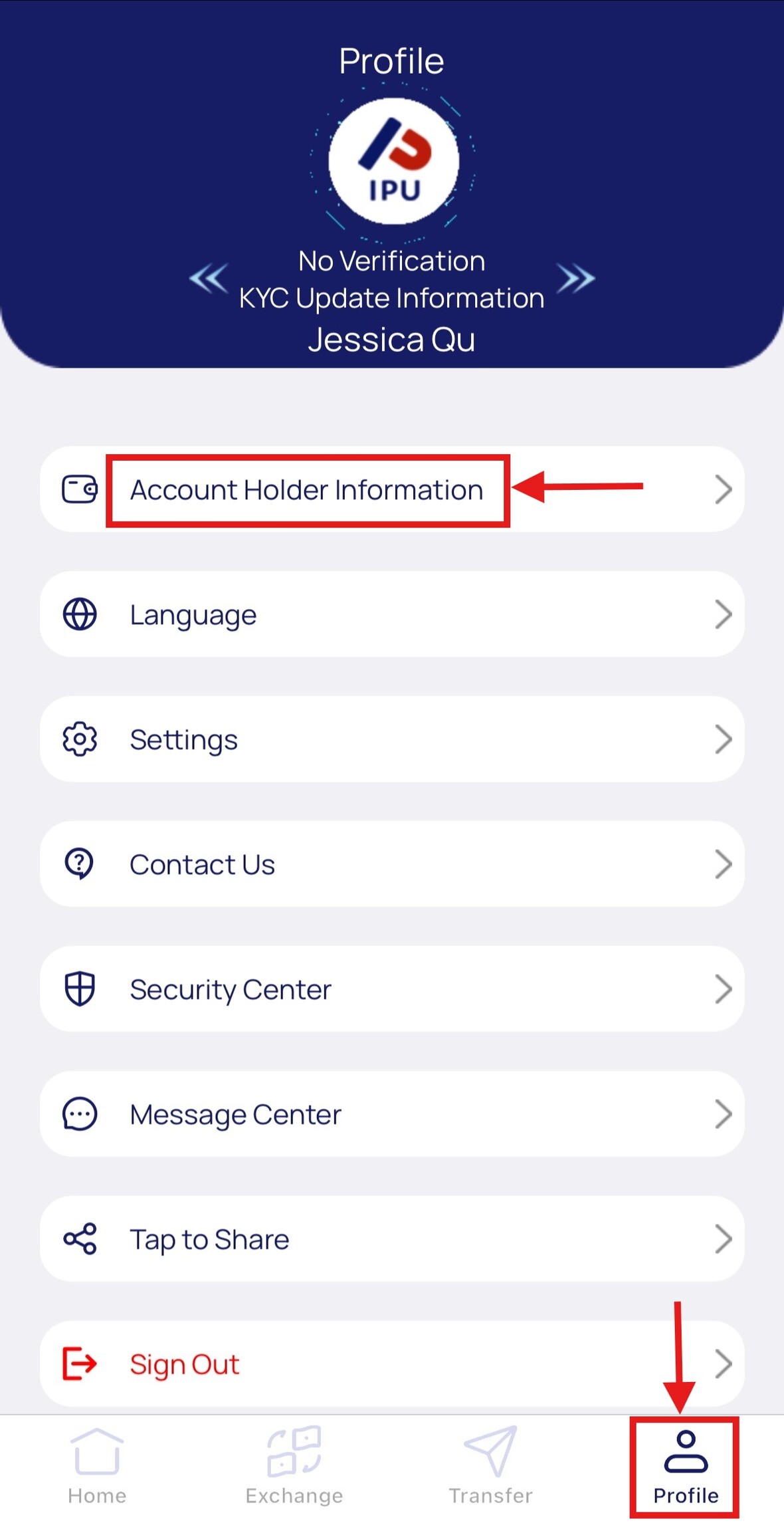

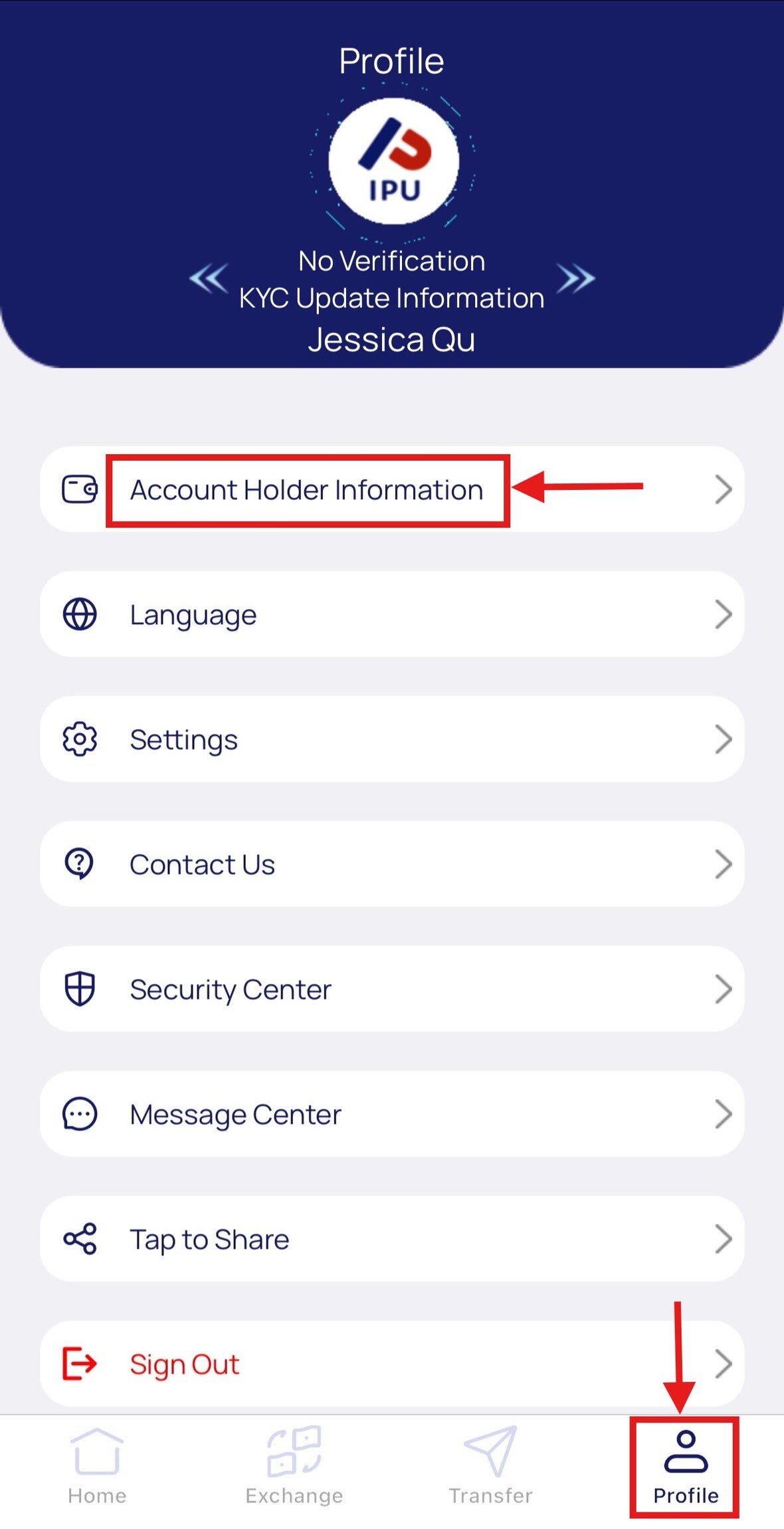

To update your account information, log in to your IPU account, go to the “My

Account” section, click on “Account Holder Information,” and edit your details as

needed.

If you experience any issues with a transaction, please contact our support team

immediately. We will investigate the issue and assist you in resolving it as quickly

as possible.

You can download the electronic account statement anytime for free via the app or

the online banking website. For example, if you need a multi-currency account

statement, log in and go to the “Multi-Currency Account” section, then select

“Transaction Statement” to download the account statement for your desired period.

01

Documents in hand before starting the application:

- Original copy of passport (or ID card for EU citizens)

- Original copy of ID card for tax payment

02

Re-verify Identity

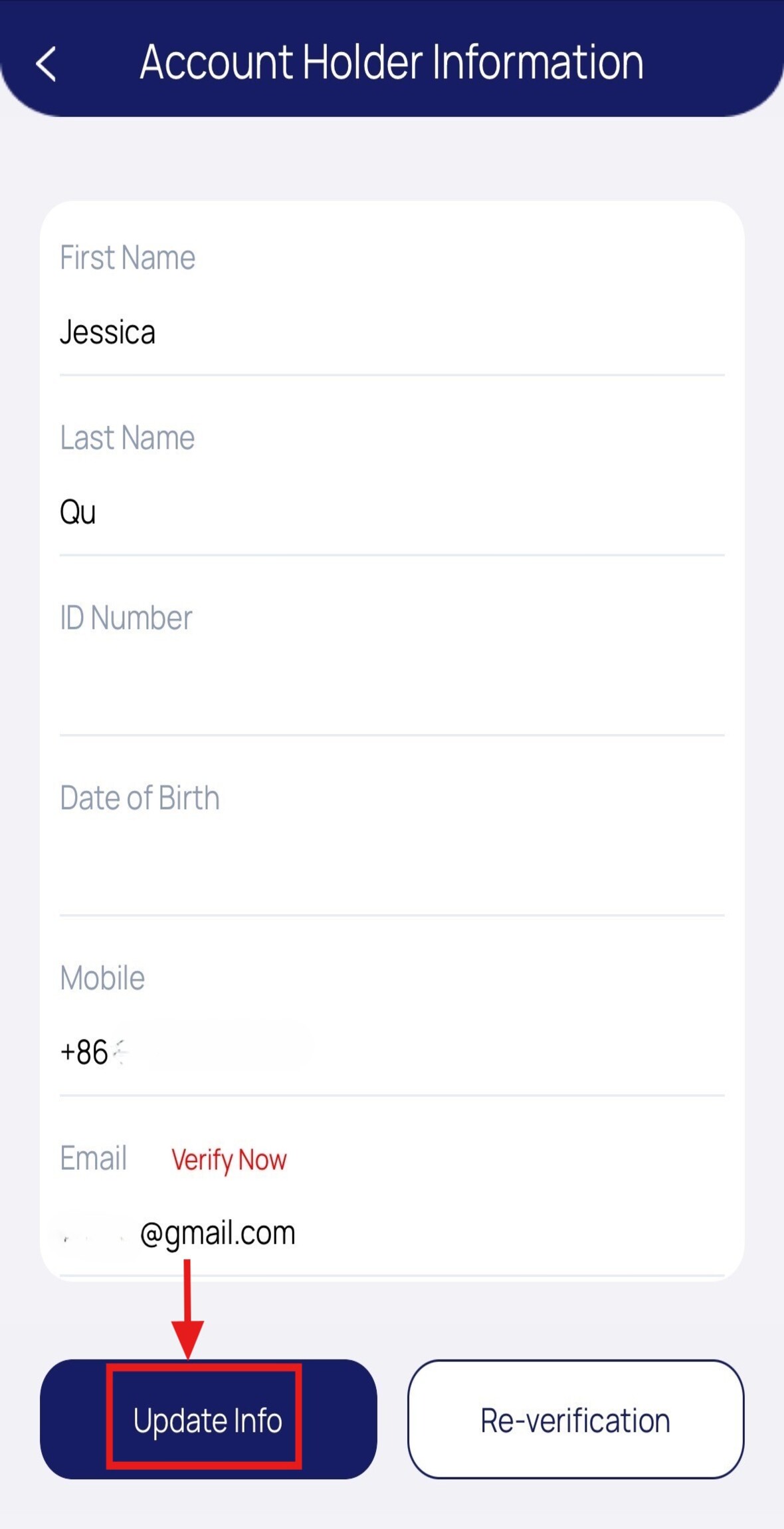

- Log In to your account on IPU mobile app.

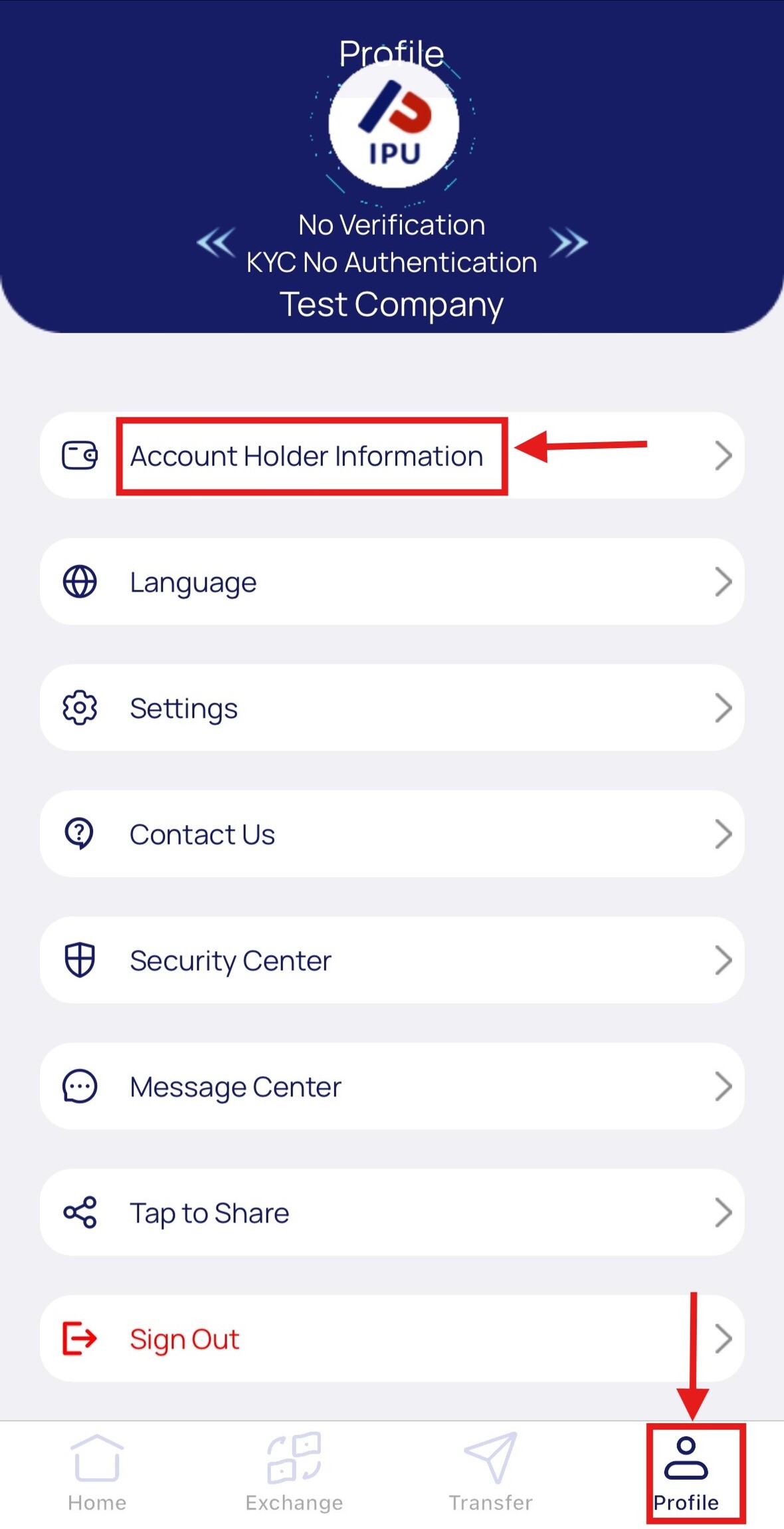

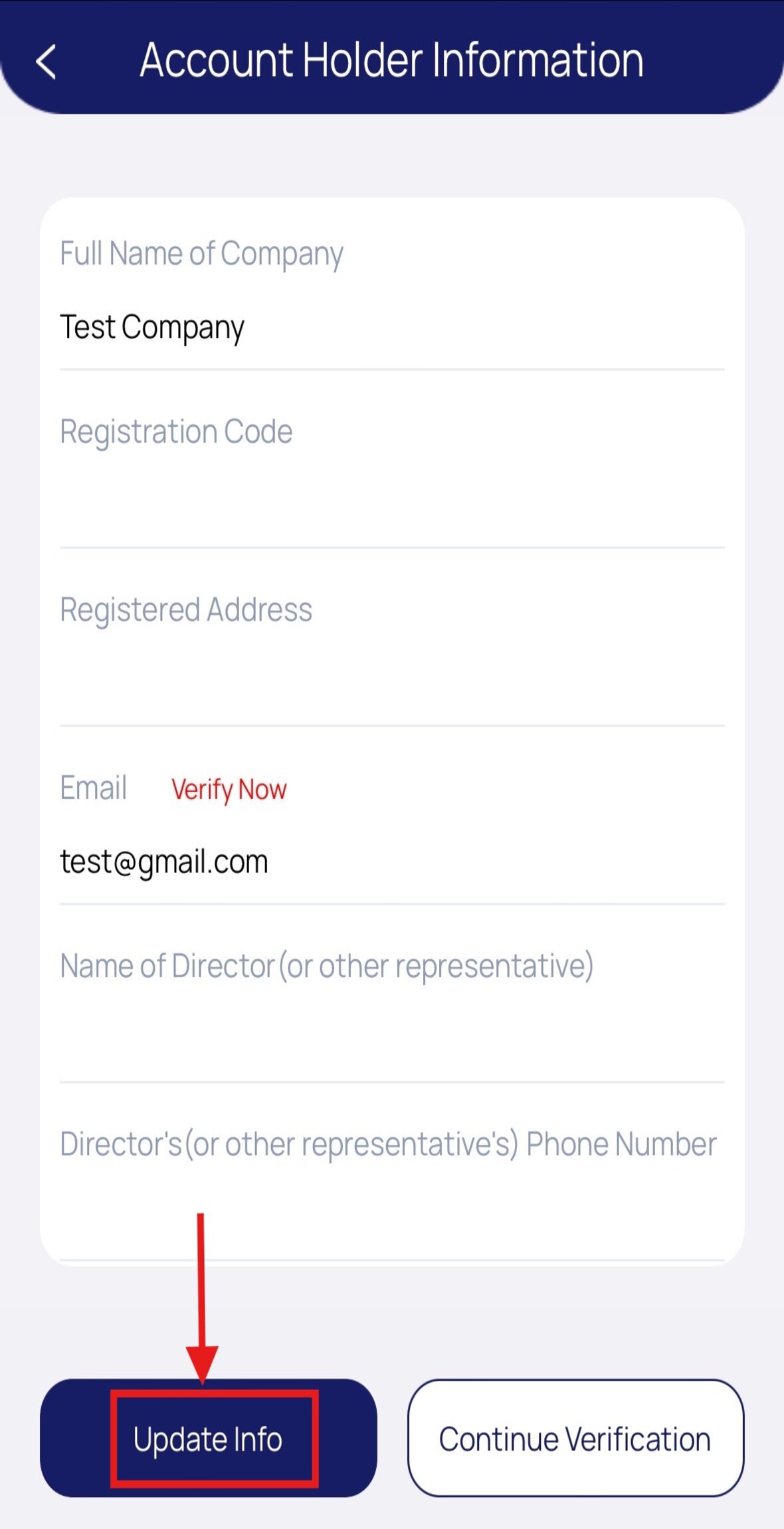

- Go to Profile > Account Holder Information, tap Update Info.

- Edit outdated fields of your passport name.

- Scan the original copy of your valid passport.

- Take a selfie.

- Identity re-verification succeeds.

03

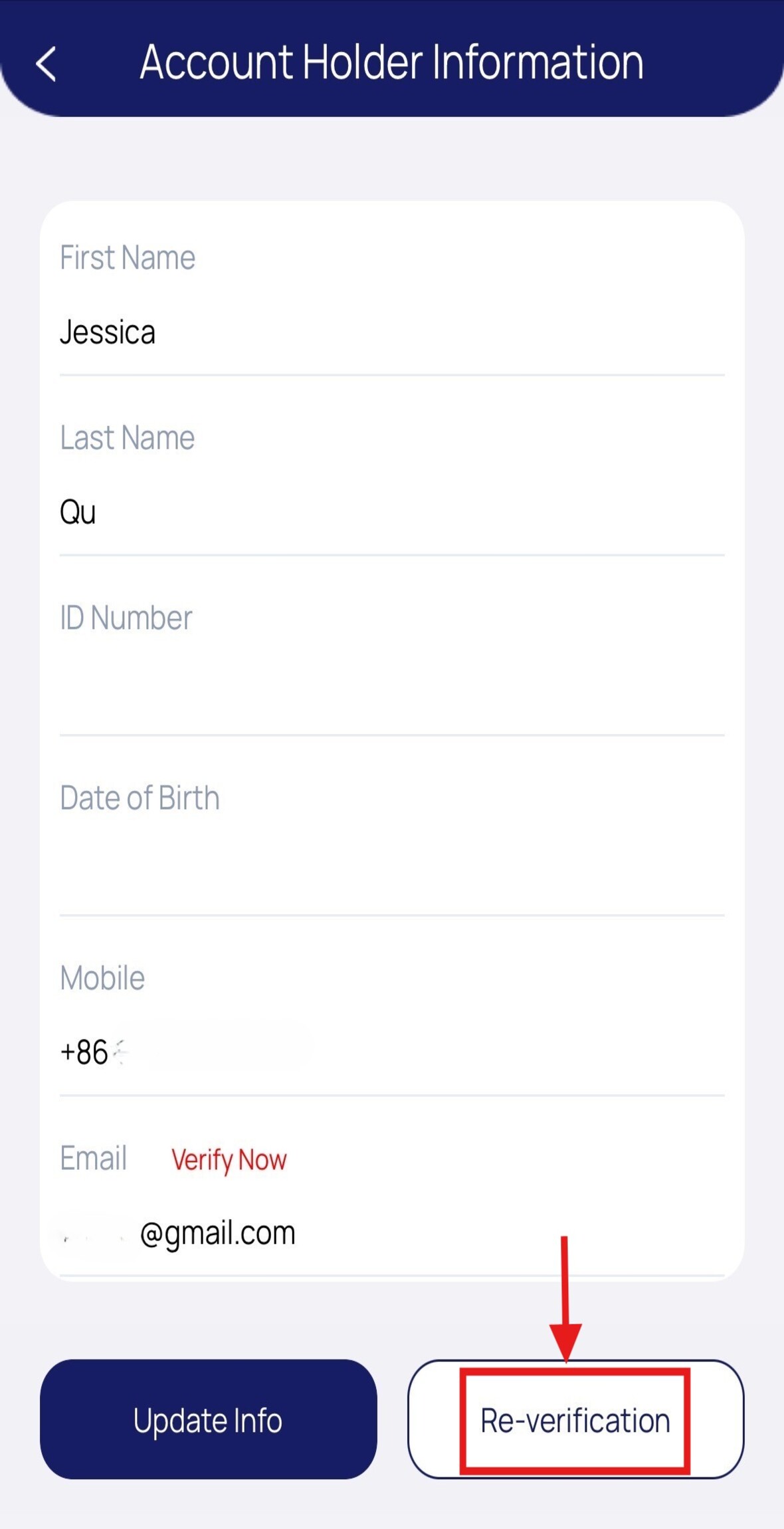

Update KYC Information

- Go to Profile > Account Holder Information, tap Re-verification.

- Edit outdated fields of your personal information.

- Upload your valid tax identification document.

- Your submission is in progress! Our team will complete the review within 1 business day.

01

Documents in hand before starting the application:

- Original copy of corporate representative’s passport (or ID card for EU citizens)

- Copy of passport/ID card of natural person shareholder who has over 25% control of the company

- Certificate of incorporation

- License to operate (if applicable)

02

Re-verify Identity

- Log In to your account on IPU mobile app.

- Go to Profile > Account Holder Information, tap Update Info.

- Edit outdated fields of the passport name of the legal representative/director of the company.

- Scan the valid original copy of the legal representative/director’s passport.

- The legal representative/director takes a selfie by him/herself.

- Identity re-verification succeeds.

03

Update KYC Information

- Go to Profile > Account Holder Information, tap Continue Verification.

- Edit outdated fields of your company information.

- Upload the valid company documents as required.

- Your submission is in progress! Our team will complete the review within 3 business days.

To open an account with IPU, visit our website or download the IPU app. Click on

the

"Sign Up" button and follow the instructions to complete the registration

process.

You will need to provide some basic information and complete identity

verification.

To open an account, you will typically need to provide a government-issued ID

(such

as a passport or driving license) and complete biometric verification (such as a

facial recognition scan). Additional documents may be required depending on the

type

of account and your location.

The account opening process usually takes a few minutes. The identity

verification

process may take 1-2 business days. Once your identity is verified, your account

will be activated, and you can start using our services.

Yes, IPU offers business accounts for companies of all sizes. To open a business

account, please visit our website or contact our sales team for more

information.

You will need to provide business registration documents, proof of identity, and

other relevant information depending on your business structure and location.

Yes, we support both EU and international users. While some high-risk countries

may

be restricted, in general, we welcome customers from around the world. Please

note

that fees might differ depending on your country of residence. For more details

please reach out to our customer support team.

No, there is no minimum deposit required to open an account with IPU.

Yes, IPU offers multi-currency accounts, allowing you to hold and manage funds

in

different currencies. You can open a multi-currency account during the sign-up

process or add one later through your account settings.

No, applying an account with IPU is free. There are no charges for account

opening,

but some transaction and account maintenance fees may apply depending on the

services you use. Please check our pricing page for details.

Once your account is successfully opened, you will receive a confirmation email

from

IPU. You can then log in to your account using the credentials provided during

the

sign-up process.

If you encounter any issues while opening an account, please contact our

customer

support team. We are available to assist you and guide you through the process.

IPU supports multiple accounts opening for corporate users. Each account will

have

its own login credentials and can be managed separately, visit our App or online

banking portal for more.

IPU offers various types of accounts, including personal accounts, business

accounts, SEPA account and multi-currency accounts. Each account type is

designed to

meet different needs, providing a range of services and features to suit your

requirements.

The restriction list may vary from time to time. Please contact our customer

service

to confirm the latest list of restricted countries.

IPU is supervised by the Central Bank, the Financial Crimes Administration, and

the

European Tax Agency, and is required to perform due diligence and KYC (Know Your

Customer) processes for account opening, which incurs costs. To ensure the best

user

experience, IPU only charges an account activation fee before the first

transaction

after the account is successfully opened. Regardless of the currency you remit,

the

system will directly deduct the equivalent amount in euros for payment.

To make a transaction, log in to your IPU account through the App or online

banking

website. Select the “Transfer” option and choose the type of transaction you

wish to

perform (e.g., transfer money, pay a bill), enter the required details, and

follow

the prompts to complete the transaction.

Transaction processing times vary depending on the type of transaction and the

destination. Internal & SEPA transactions typically process within a few minutes

to

a few hours. International transactions via SWIFT may take 1-3 business days,

depending on the review process and the receiving bank. Please check specific

transaction details for more accurate timing.

Fees may apply depending on the type of transaction and the destination. For a

detailed breakdown of transaction fees, please refer to our fee schedule on the

IPU

website or contact customer support.

Once a transaction has been initiated, it may be possible to cancel it depending

on

the type of transfer, and a fee might be incurred. If you need to cancel a

transaction, please contact our customer support team immediately for

assistance.

You can track the status of your transaction by logging in to your IPU account,

click on “Transfer” and navigating to the “Transaction Records” section. Here,

you

will find “Detail” and the current status of all your recent transactions.

If a transaction fails or is declined, check to ensure that you have entered the

correct information and that there are sufficient funds in your account, and the

transfer details are correct. If the issue persists, please contact our customer

support team for further assistance.

Yes, there are daily and monthly transaction limits to ensure security and

compliance. For details, please contact customer support.

Transaction notifications will be sent to your registered email and push

notifications to keep you updated on your account activity at all times.

Yes, you can set up recurring transactions for scheduled payments. Log in to

your

IPU account, choose the “Transfer” option, select “Scheduled Transfer” and set

the

frequency, amount, and recipient details.

If you suspect any unauthorized transactions on your account, contact our

customer

support team immediately. We will investigate the matter and take appropriate

steps

to secure your account.

Yes, IPU supports multi-currency transactions. You can choose the currency you

wish

to transact in by selecting the appropriate currency account during the

transaction

process.

You can download a detailed statement of your transactions anytime for free

through

the IPU app or online banking website. Log in, navigate to the “Transfer

Records”

section, click on the specific transaction you need, and choose the “Receipt”

option

in the top right corner to download your transaction statement.

IPU uses advanced security measures, including encryption, multi-factor

authentication, and secure access protocols, to protect your account and

personal

information. We continuously monitor and update our security systems to guard

against unauthorized access and cyber threats.

The IPU core system is certified by the European Central Bank and directly

connected

to the Central Bank’s clearing system. Its system security standards meet the

requirements of European financial institutions, ensuring the highest level of

security and reliability.

Yes, protecting your personal information is a top priority for IPU. We comply

with

GDPR and other relevant data protection regulations. Your data is stored

securely,

and access is strictly controlled and monitored.

If you suspect any fraudulent activity on your account, contact our customer

support

team immediately. We will investigate the issue and take necessary actions to

secure

your account and prevent further unauthorized transactions.

IPU is committed to safeguarding your data privacy. We adhere to strict data

protection policies and only collect, use, and share your information as

outlined in

our Privacy Policy. Your data is never sold or shared with unauthorized third

parties.

Yes, all transactions processed through IPU are secure. We use advanced

encryption

technologies and follow industry best practices to ensure the safety of your

transactions. Each transaction is monitored for suspicious activity to provide

an

additional layer of security.

Multi-factor authentication (MFA) is a security process that requires more than

one

method of verification to access your account. This includes something you know

(like a password) and something you have (like a code sent to your phone). MFA

adds

an extra layer of security, making it more difficult for unauthorized users to

access your account.

IPU employs a dedicated team of cybersecurity experts who monitor our systems

24/7.

We use state-of-the-art security technologies, including firewalls, intrusion

detection systems, and regular security audits, to protect against cyber threats

and

ensure the safety of our users.

IPU only shares your information with third parties when it is necessary to

provide

our services, comply with legal obligations, or protect our rights. All third

parties are carefully vetted to ensure they meet our high standards for data

protection and security.

To enhance the security of your IPU account, use a strong and unique password,

multi-factor authentication is compulsory, regularly monitor your account

activity,

and avoid sharing your login details with others. Additionally, ensure that your

devices and software are updated to protect against vulnerabilities.

In the unlikely event of a data breach, IPU has a comprehensive incident

response

plan to quickly identify, contain, and mitigate the impact of the breach. We

will

notify affected users promptly and provide guidance on steps to protect their

accounts and information.